If you spend just a few minutes, you can save a lot of money.

For the past two decades, I’ve counseled Americans on their debts. Sometimes, those debts have tragic causes: divorce, death in the family, chronic illness, serious accident, or even a natural disaster.

More often, personal debt has mundane roots: not paying attention to your spending, not keeping a budget, ignoring a budget, and trying to keep up appearances. My all-time favorite reason: blown deadlines.

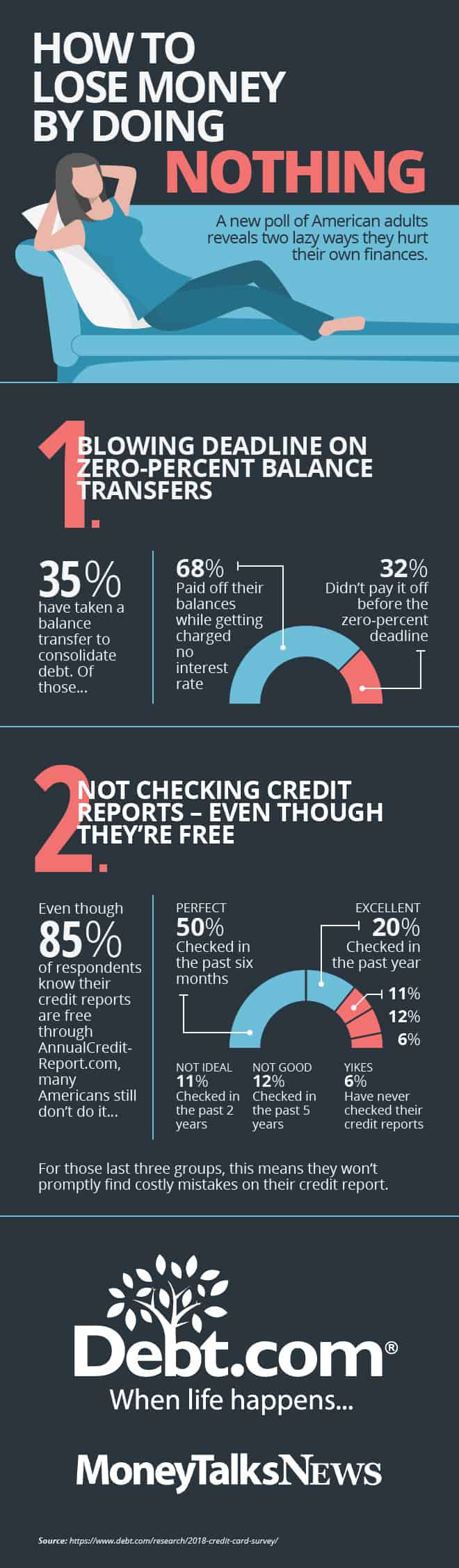

If you want a recent example of what I’m talking about, look no further than the latest Debt.com/Money Talks News poll. In it, we asked thousands of adults about two topics: How often they check their credit reports, and if they take advantage of what’s called “zero-percent transfer offers” on certain credit cards. Let’s break it down before tying it all together…

Credit reports

Personal finance experts disagree on many things: Which debts to pay off first, how much you need in an emergency fund, whether you should borrow from your 401(k). They all agree on this: Check your credit reports.

Why? Because it matters and it’s free.

If you go to AnnualCreditReport.com, you can fetch your credit reports from the Big Three credit bureaus (Equifax, Experian, and TransUnion). All those personal finance experts recommend you pull one report every four months. It costs you nothing, and it’ll help you quickly notice any mistakes — and there are lots of mistakes.

The Federal Trade Commission has said a fifth of Americans have what’s called a “confirmed material error” on at least one of their reports. It’s not intentional or even sloppy. Those credit bureaus process an enormous amount of information every day, so even if they err one time in a million, that’s still a lot of mistakes.

Those mistakes can cost you because lenders use your credit reports to set interest rates on everything from credit cards to mortgages. If you notice a mistake, you can get it removed. (Learn how at Credit Repair: How to Fix Your Credit Report.)

The good news from the Debt.com/Money Talks News poll was that 85 percent of respondents knew about this. Alas, knowing and doing are quite different things.

Almost a quarter (24 percent) haven’t check their credit reports in two to five years, and astoundingly, 5 percent have never checked. That means these individuals might be saddled with higher interest rates simply because they didn’t take five minutes — and I’m not exaggerating the time investment — to save potentially thousands of dollars over their lifetimes.

Balance transfer offers

Speaking of high interest rates, one of the easiest ways to pay down your credit card balances is to roll over that debt to a special card. These cards, which we’ve described in depth before, will charge you no interest at all. That’s quite a deal when you consider the average interest rate on a credit card these days is hovering around 18 percent.

Of course, there’s a catch. The zero-percent interest rate is temporary. It expires as early as six months or as long as 18 months. After that, you pay an interest rate that’s often higher than the original card you had.

Not surprisingly, many people don’t pay off their balances by the time the deadline passes. Otherwise, these offers wouldn’t exist. Credit card companies are in business to make money, and not charging interest isn’t in their interest.

However, I was surprised at just how many people get caught in this trap. In our poll, almost a third (32 percent) didn’t pay off their balances before the no-interest offer expired.

What happens after that? We didn’t ask this question, but perhaps we will in subsequent surveys: Do you know what credit counseling is? It offers a debt analysis that’s as free as a credit report. If this column sounds like it’s describing you in any fashion, I urge you to call Debt.com for free advice. Don’t wait for the next poll.