If so, there's a right way and a wrong way. The right way is called "allowance." The wrong way is called "cookies."

Yesterday marked the kick-off for the first-ever National Bribe Your Child Week. It’s a provocative marketing effort from Great American Cookies, an online dessert company.

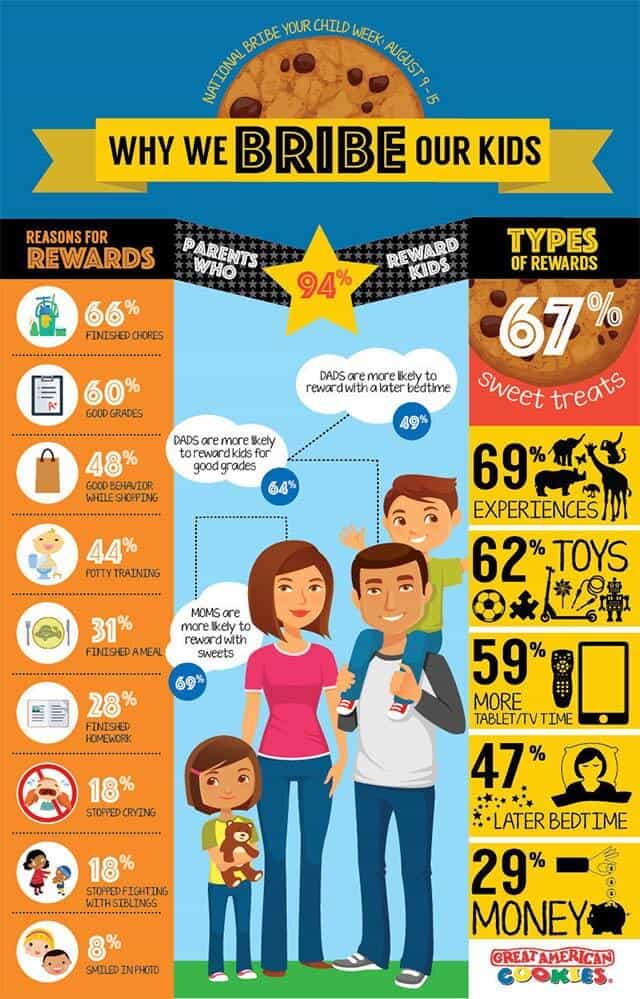

It’s quite clever, actually. To help sell more cookies, the company encourages parents to bribe their children to do well in school or finish their chores — all in exchange for a cookie. Great American Cookies even polled parents and found,

80 percent of parents with children ages two through four have rewarded their children with sweet treats. Other types of rewards included more tablet/TV time (59 percent), new toys (62 percent), and a later bedtime (47 percent).

My first thought after reading the poll was: “Whatever happened to kids allowance?”

The wrong way to bribe a child

The poll (see the infographic at the end of this post) shows that 67 percent of parents reward their children with “sweets” for successfully completing tasks ranging from finishing homework to not fighting with their siblings. Other rewards include buying toys (62 percent), allowing more TV time (59 percent), and going to bed later (47 percent).

In last place is money. In my mind, it should be first.

Money teaches twice

While the bribery poll wasn’t the most scientific ever conducted — it was done on SurveyMonkey and even the cookie company concedes it’s “not based on a probability sample” — it’s still worthy of analysis.

Why? Because it’s an opportunity to promote a cause of my own: Teaching children and teens (and even adult children) about financial literacy.

The best way of doing that is by starting them young with an allowance they can spend as they please. You teach them twice…

- They learn to earn. You don’t hand out an allowance for just existing. You require work, and you demand it be done right. Was only half the job completed? Then they receive half their allowance.

- They learn to save. If your children blow their allowance on candy every week but really want the latest video game cartridge that will require several months of scrimping, you can help by offering to hold the money in the Bank of Mom and Dad — and offer a generous interest rate to encourage long-term planning.

To me, this beats handing out cookies for making the bed. Not only is it more educational, it’s also less fattening.

Howard Dvorkin is a CPA and chairman of Debt.com, an educational resource for those who want to conquer all forms of debt in their lives.