It's the middle of January already. This is it for wrapping financial advice around the turning of the calendar.

Here’s my new year’s resolution: This will be the last time I write about new year’s resolutions until 2016.

I can’t help myself this one last time, because the financial website GoBankingRates.com released a fascinating poll this month that found 37 percent of Americans made a new year’s resolution to save more money — but “nearly one in four respondents aren’t at all confident that they’ll be able to meet this resolution.”

That number didn’t shock me. I often speak to successful, smart adults who are resigned to living in the stressful, dead-end world of debt. Much of what I do here at Debt.com is convince people they can conquer debt, either on their own or with professional help.

No, what fascinated me most about the GobankingRates poll was the way it broke down the answer by age and gender. Let’s take a look, and then tackle what the poll calls “the Biggest Obstacles to Saving in 2015.”

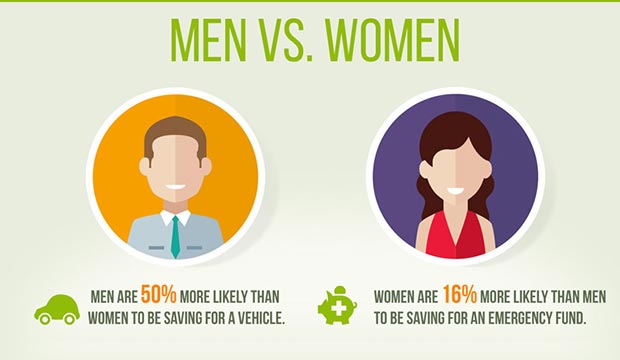

Men and women and money

It’s no real surprise that men want to spend their savings on a car and women prefer to build an emergency fund. However, men aren’t only thinking of themselves: “Men are more likely to be saving for a family and education — roughly 30 and 26 percent more, respectively.”

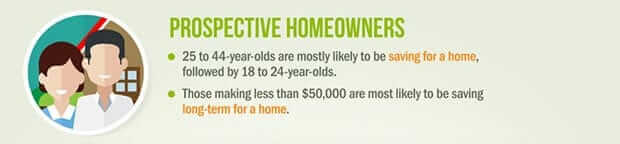

The young and the homebuyers

Millennials get a bad rap as a tech-addled generation with no attention span. The GoBankingRates poll reveals otherwise, and this is just one example. “Saving for a family was the top long-term goal among 18 -to 24-year-olds,” the poll concludes, although it adds, “this age group was the least likely to be saving for retirement or an emergency fund.”

No surprise there, since Millennials came of age in a recession and are burdened with record levels of student loan debt. However, they’re thinking about raising a family in a home of their own, and you can’t come up with a more traditional value than that.

Boomers or bust

Given that Baby Boomers are fast approaching retirement, it’s a good sign they’re saving for it, even though most other research indicates they’re woefully unprepared. Still, the GoBankingRates poll shows they realize they have a problem, which is the first step to solving it.

The poll didn’t explain why Boomers listed home repairs and renovations as a saving priority, but I suspect it’s because they’re considering downsizing — selling the homes they raises their families in, buying a smaller place, and investing the difference in their retirement accounts. If my hunch is correct, another good sign.

Avoiding the obstacles

The poll also asked what were the “biggest obstacles” to achieving savings goals. Not surprisingly, “insufficient income” and “unemployment” topped the list. However, the total was just under 37 percent and 10 percent, respectively.

Of course, even 1 percent is too much in either category, but the other reasons stuck out most to me: “poor money management” (10.75 percent) and “credit card debt” (9.55 percent).

For that nearly 20 percent, their savings problems are solvable. They can be on their way to meeting all their financial goals well before 2016 rolls around. How? All they need to do is start at the student loan debt section of our Education Center.

Here’s my final new year’s resolution: Help every American get debt help in 2015. I hope you’ll help me reach that goal.

Howard Dvorkin is a CPA and chairman of Debt.com, an educational resource for those who want to conquer all forms of debt in their lives.