When it comes to their finances, Americans excel at one thing: Worrying about money. Unfortunately, they’re not so adept at doing something about it.

While I’ve anecdotally known this for more than two decades — ever since I began counseling Americans on their debts — three new surveys just reinforce the idea…

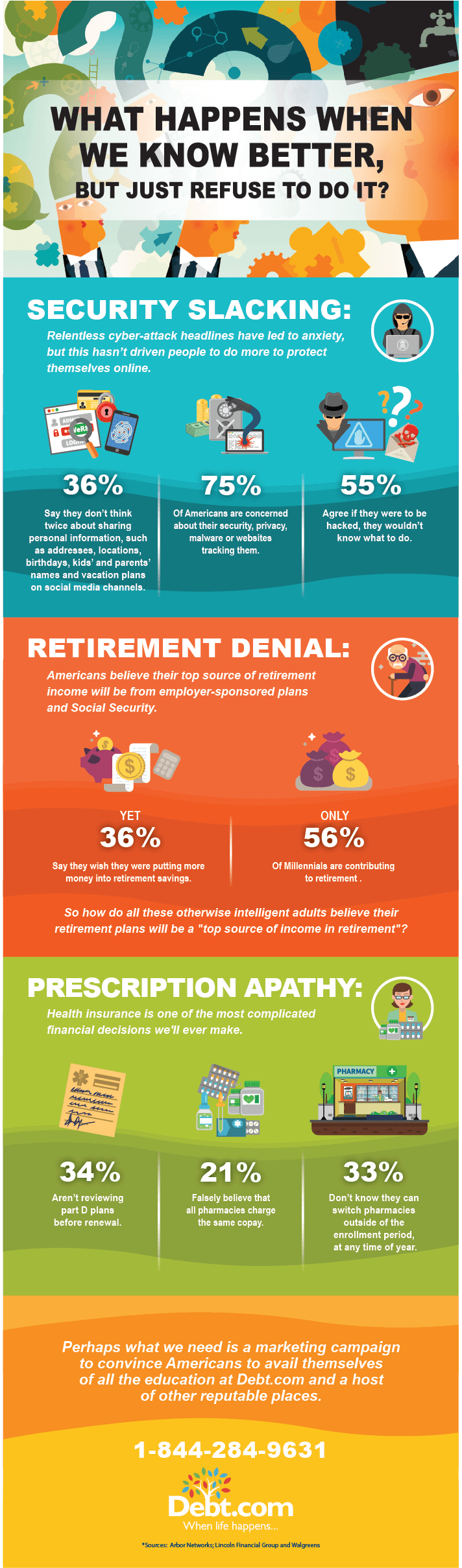

Security slacking

According to online security firm Arbor Networks, 75 percent of Americans are “concerned about their security, privacy, malware or websites tracking them.” They also know identity theft can cost them thousands of dollars.

So what are they doing about it? This…

- “55 percent say if they receive an email from someone they know with a link, they usually click it even if they weren’t expecting anything.”

- “55 percent agree if they were to be hacked, they wouldn’t know what to do.”

- “36 percent say they do not think twice about sharing their personal information, such as addresses, locations, birthdays, kids’ and parents’ names and vacation plans on social media channels.”

This shocks Arbor Networks CMO Christopher Gaebler: “The big takeaway from this survey is that the relentless headlines about cyber-attacks have led to anxiety among a vast majority of Americans. Ironically, this has not driven people to do more to protect themselves online, but quite the contrary.”

Retirement denial

“Americans believe their top sources of income in retirement will be the money they have saved through employer-sponsored plans and Social Security,” says Lincoln Financial Group.

Yet “36 percent say they wish they were putting more money into their retirement savings plans, but more than half are prioritizing paying off short-term debt over saving for retirement.”

For millennials, only 56 percent “are contributing to a retirement savings plan” at all.

So how do all these otherwise intelligent adults believe their retirement plans will be a “top source of income in retirement”?

Prescription apathy

Here’s a long, disturbing headline from a Walgreens poll…

Prescription Drug Costs Are a Top Concern for Many Medicare Beneficiaries, Yet 34 Percent Aren’t Reviewing Part D Plans Before Renewal

Health insurance is perhaps the most complicated financial decision we’ll ever make — right up there with the impenetrable paperwork that comes with securing a mortgage. Still, it’s concerning when Medicare beneficiaries…

- “falsely believe that all pharmacies charge the same copay” (21 percent)

- “don’t know they can switch pharmacies outside of the enrollment period, at any time of year” (33 percent)

- “look at just one component, checking, for example, to see if their own medications are covered, yet not looking at any other important considerations” (22 percent)

Says John Lee, senior director of Medicare for Walgreens: “This latest survey reinforces the need to educate beneficiaries about how plans and coverage can and do change from year to year, as can a person’s health and prescription needs.”

I’m not so sure Lee is correct. Of course, I always advocate for more education on every aspect of financial life. However, I’m not sure most Americans want that education. These recent polls seem to back that up.

Perhaps what we need is a marketing campaign to convince Americans to avail themselves of all the education already out there, at Debt.com and a host of other reputable places.