I hope the credit bureaus are right, and I'm wrong.

Last week, representatives from the Big Three credit bureaus — Equifax, Experian, and TransUnion — met in New Orleans for a conference.

In between jaunts down Bourbon Street, the attendees at the 21st Annual Vehicle Financing Conference discussed the big issue worrying financial experts these days: the so-called “auto bubble.”

Sadly, most consumers aren’t aware of this potential crisis. That’s probably why many folks doubt me when I write, “Are car loans the next mortgage crisis?” They haven’t heard it from anyone else.

Before President Trump’s inauguration, I even predicted another recession literally driven by the massive growth in auto loans to Americans who can barely afford them.

Reports

At the Vehicle Financing Conference last week, Equifax discussed what it called “mixed reports and conflicting analysis” about the auto bubble. The statement never hit the mainstream media because it was issued under the headline, Equifax Joins Other Consumer Credit Bureaus to Level-Set on Health of Subprime Auto Lending Market.

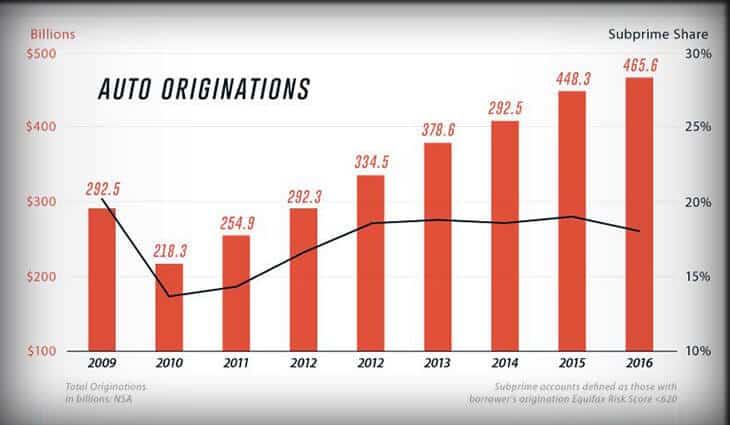

While Equifax presents detailed analysis that can be construed as reassuring, the chart atop this post speaks volumes. So does this single fact in a Requisite Press report from mid-December, which I never saw reported…

Three out of four U.S. consumers believe that new vehicles are unaffordable. This comes as income growth is slowing and affordability gains are minimal. … A prudent, median-income household can afford 58.9 percent of the light-vehicle average transaction price.

This tells me the auto bubble will become a problem if it isn’t already one. After all, if the average American can afford just over half of the average new vehicle, the logical conclusion is that auto loans are going to continue to skyrocket.

While many experts might see an auto loan crisis as remote; I’m reminded that very few of us predicted the housing bubble. Those who saw it coming (as I did) didn’t realize just how deep it would go.

I don’t like being wrong, but this is one time when I’d gladly admit it and even toast it.