Featured Content

Browse by Topic

Recent News

Credit Utilization: Understand How It Impacts Your Credit Score

By: Casey Bond | Source: U.S. News & World Report

“Credit utilization makes up such a significant part of your score because if you’re maxing out credit cards, lenders may assume that you are living beyond your means, ultimately deeming you as a credit risk,” says Howard Dvorkin, a CPA, author, columnist and chairman of personal finance site Debt.com.

5 Things to Do Now to Protect Your Money During High Inflation

By: Jared Lindzon | Source: Time

Having a budget is always the best way to keep costs under control, and in recent years inflation has caused many Americans to take up the practice. According to a survey by debt.com, 80% budgeted their expenses in 2021, compared with only 68% in 2019.

Housing market already shows signs of slowing down, experts say

By: Mark Huffman | Source: Consumer Affairs

For would-be buyers, it may also turn out to be an opportunity if the market softens. Howard Dvorkin, a CPA and chairman of Florida-based Debt.com, says this is no time for buyers to take on a debt that may prove to be unmanageable. “If you find yourself saying out loud, ‘I think I can stretch my budget to buy this home,’ don’t do it,” Dvorkin told ConsumerAffairs. “Your budget will be stretched after you buy a home. Don’t forget all the background expenses that go into a just-bought home – from taxes to furnishings, from repairs to maintenance.”

Looking for Scholarships to Pay Student Loans? Check Out Grants Instead

By: Dan Clarendon | Source: Market Realist

Howard Dvorkin, CPA and chairman of Debt.com, says in a Q&A on that website that most scholarships don’t check how recipients use the money. However, he adds that scholarships usually don’t help pay off student loans, since you have to be enrolled in college to get a scholarship.

3 Budgeting Tips For An Uncertain Future

By: E. Napoletano, Korrena Bailie | Source: Forbes

“These sound like boring answers to the heavy question of financial security during scary times,” says Howard Dvorkin, CPA and chairman of Debt.com, “but too many people overreact and take big risks instead of checking first to see if they’ve done all the basics.”

Red flags of peer-to-peer lending

By: Emma Woodward | Source: Bankrate

“If you’re fed up with bank fees, you’ll really hate P2P loans,” says Howard Dvorkin, CPA and Chairman of Debt.com. “On top of the interest rate you’ll pay, there’s the origination fee, which can be as low as 1 percent but as high as 8 percent. That’s much more than a bank or credit union will charge you for a personal loan.”

Business Travel Is Back: How to Maximize Your Miles

By: Beth Braverman | Source: Success Magazine

“People have gotten used to Zoom meetings, but that’s still no substitute for shaking hands and seeing someone in a social setting,” says Howard Dvorkin, a New Jersey-based certified public accountant and chairman of Debt.com. “That being said, they’re still going to evaluate whether travel is necessary.”

When buy now, pay later comes back to bite you

By: Jessica Dickler | Source: CNBC

“People are buying ‘wants’ not ‘needs,’” said Howard Dvorkin, CPA and chairperson of Debt.com.

How to help your child build credit

By: Jacqueline DeMarco | Source: creditcards.com

Howard Dvorkin, CPA and chairman of Debt.com and author of “Power Up: Taking Charge of Your Financial Destiny,” compared building credit with voting. “You need to be 18, but you can start preparing years before,” Dvorkin noted. “You can learn how things work so you can make informed decisions when the time comes. Since the minimum age for a credit card is 18, parents should use the years before that to teach their children how to be financially responsible adults.”

Last-Minute Ways To Reduce Your Taxes for 2022

By: Nicole Spector | Source: Yahoo! Finance

“Call your Human Resources Department,” said Howard Dvorkin, CPA and chairman of Debt.com. “You might have work benefits that offer tax breaks. These are pretty specific.

Tips For Managing Your Finance Strategy That You Didn’t Learn In School

By: Dr. Morissa Schwartz | Source: Forbes

“If your budget or spending is unorganized, it will be easy to accumulate debt quickly and get in over your head. Make an outline of all of your expenses, allocate whatever amount of money is necessary in order for you to operate, and adhere to the limits that you set yourself,” Howard Dvorkin, CPA and personal finance expert at Debt.com, tells Inc.

Avoiding Delays This Upcoming Tax Season

By: Sasha Jones | Source: NBC 6 South Florida

“A lot of clients come in and say they don’t like filing electronically, and I say, why not. There is no reason not to in this day and age,” Howard Dvorkin, a certified public accountant, said.

Browse by Topic

Recent Columns

Dvorkin On Debt: Presidential Polling Isn’t The Most Important Kind

By: Howard Dvorkin

Although presidential polling is all the news covers during elections, where polling matters most isn’t in politics. It’s in personal finance.

Dvorkin On Debt: 4 Funny and Frustrating Financial Facts

By: Howard Dvorkin

As a finance counselor and a CPA at Debt.com, here’s what I’ve learned so far this month. It’s made me both laugh and cry.

Dvorkin On Debt: This Week’s Good News And Bad News

By: Howard Dvorkin

Are Americans wising up about personal debt? Or are they doubling down? Here’s the good news and bad news surrounding the issue.

Dvorkin On Debt: Tax Season Can Be Pleasing

By: Howard Dvorkin

Filing your taxes isn’t fun, but the results can still make you smile.

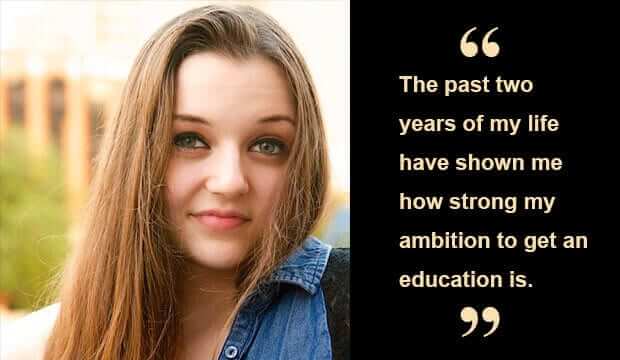

Sick And Tired And Successful

By: Howard Dvorkin

The latest Debt.com winner of a scholarship for college won’t let illness slow her down – or get her down. In fact, it has helped her form new career goals.

Money Can’t Buy You Love – But It Can Ruin It

By: Howard Dvorkin

It’s not a romantic topic, but it’s perhaps the most important one. Here’s how money ruins relationships if you’re not careful.

Dvorkin on Debt: One Emotion Dooms Your Finances

By: Howard Dvorkin

It’s not depression. Or happiness. Or love. Or hate. Fear of credit is what can really wreck your chances at better financial success.

Dvorkin on Debt: Changing “Impulsive” To “Repulsive”

By: Howard Dvorkin

How much do you spend impulsively? If it’s more than $100, you’re typical – and in trouble. Here’s our advice on cutting back impulse buys.

Dvorkin on Debt: A One-Two Sucker Punch

By: Howard Dvorkin

As we lurch into 2016, personal debt might be a bigger problem than it was in 2015. Here are some new statistics on credit card debt, and what may happen.

Dvorkin on Debt: Your Holiday Debt Hangover Has Arrived

By: Howard Dvorkin

Holiday debt. It may not be just a hangover. It might be a disease. Here’s the cure. Read financial advice on skipping disaster by getting clear of debt.

Dvorkin On Debt: Blue Monday And Red Tuesday

By: Howard Dvorkin

Maybe you’ve heard about Blue Monday, a “holiday” mainly about holiday debt. But you didn’t know about Red Tuesday — and here’s why.

Dvorkin On Debt: The Best Things In Life Aren’t Free…

By: Howard Dvorkin

…but the most important ones are. Here’s how to get free debt help and start 2016 off right. If your new year’s resolution is to fix debt, we can help.