Featured Content

Browse by Topic

Recent News

99 Cents Only Stores Clearance

By: Donna Fuscaldo | Source: AARP

“Stocking up on non-perishable items like canned goods, dry goods, cleaning supplies, and household staples can save a lot of money. These items typically have a longer shelf life and will last,”

How to get cash from a credit card

By: Ben Luthi, Melanie Pincus & Jasmin Baron | Source: CNN Underscored

“Sometimes, these offers only apply if you use the check to transfer a balance to that particular card,” “If you deposit the check into your bank account, you could be paying upwards of 20% interest plus fees.”

Red flags of peer-to-peer lending

By: Emma Woodward | Source: Bankrate

“If you’re fed up with bank fees, you’ll really hate P2P loans,” “On top of the interest rate you’ll pay, there’s the origination fee, which can be as low as 1 percent but as high as 8 percent. That’s much more than a bank or credit union will charge you for a personal loan.”

Tips for Couples Talking About Money

By: Adriana Morga | Source: Florida Realtors

“You should talk about money, lifestyle, goals and dreams,” he said. “Because (money) affects your dreams, and if you go into a relationship with debt, your dreams may be altered.”

How Baby Boomers Stay Free of Credit Card Debt

By: Heather Taylor | Source: Go Banking Rates

“They’re not usually the type to download the latest hot app, but they have become more comfortable with online budgeting programs that safely do the heavy lifting for you,” said Dvorkin. “Many banks and credit unions are also getting in on the act, offering many budgeting tools on their websites. There’s literally no excuse for not budgeting — because a computer will do the math for you.”

Are Adjustable-Rate Mortgages a Good Move Right Now?

By: Pete Grieve | Source: Money

“If you’re forced to take a loan out right now, it probably should be a variable, in my opinion,” says Howard Dvorkin, founder of Debt.com.

3 questions to ask before pursuing debt relief

By: Aly Yale | Source: CBS News MoneyWatch

“If you have less than $5,000 in debt and a steady income, you should consider whether you can try to pay that off with a little discipline and mild sacrifice,” says Howard Dvorkin, chairman of Debt.com. “Debt relief programs aren’t free, because those experts you’re consulting need to earn a salary, too. So, it only makes sense if you have significant debt, you just can’t pay down on your own.”

Is debt relief the right option for you? Here’s what experts say

By: Aly Yale | Source: CBS News MoneyWatch

“Debt relief is a broad term, encompassing a number of solutions,” says Howard Dvorkin, chairman of Debt.com. “It’s kind of like asking, ‘What is a diet?’ There are as many ways to shed debt as there are to shed weight.”

Best places to save money and earn interest in 2024

By: Cassidy Horton and Ashley Barnett | Source: USA Today

“If you have access to a 401(k),” said Howard Dvorkin, chairman at Debt.com, “then that’s easily the most lucrative safe space for your hard-earned cash.”

How to cash a check without a bank account

By: Holly Johnson, Ali Cybulski & Adam McFadden | Source: CNN Underscored

“Start with the check’s issuing bank — the name of the bank printed on the check — if you need to cash a check without a bank account. For example, a check from someone who banks at Chase could be cashed at your local Chase branch, if one is available,” “The account needs to have enough money in the payer’s account to cover it, and the payee will need to show a government-issued ID to cash the check,”

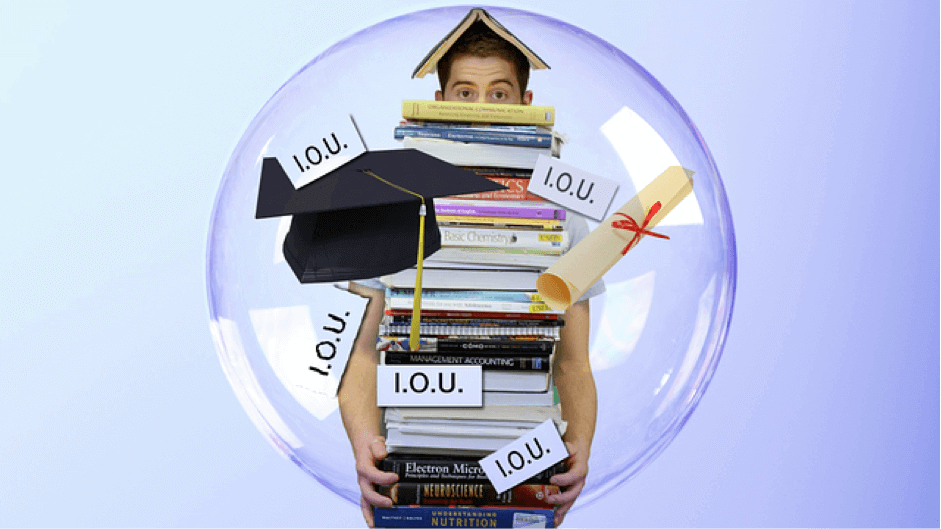

As Loan Default Rates Remain Steady, Many Young Borrowers Are Unaware of What This Means

By: Hanneh Bareham | Source: Bankrate

“I can only speculate why defaults are suddenly up in this age group, but I wonder if student loans play a part,” “After three years of frozen payments due to the pandemic, October marked the thaw. Coupled with inflation, that could be the one-two punch that drove up defaults,”

Browse by Topic

Recent Columns

What The “Next Recession” Experts Are Missing

By: Howard Dvorkin

It’s so obvious, why aren’t they mentioning it? I’ve previously predicted the next recession in 2018 although it won’t necessarily be Trumps fault.

3 Discouraging (And 2 Encouraging) Facts About Americans And Their Money

By: Howard Dvorkin

How are Americans and their finances? It’s complicated. There’s seldom good news about Americans’ debts. Can it get any worse? Sure it can.

In Defense Of Capitalism As A Way To Get Out Of Debt

By: Howard Dvorkin

I’ve created and operated businesses that help Americans climb out of crushing personal debt. If I’ve learned anything, it’s this…

3 Revealing Money Facts You Probably Haven’t Heard About

By: Howard Dvorkin

You probably haven’t heard about these revealing money facts. That’s why it’s so important that personal finance become not just a personal topic.

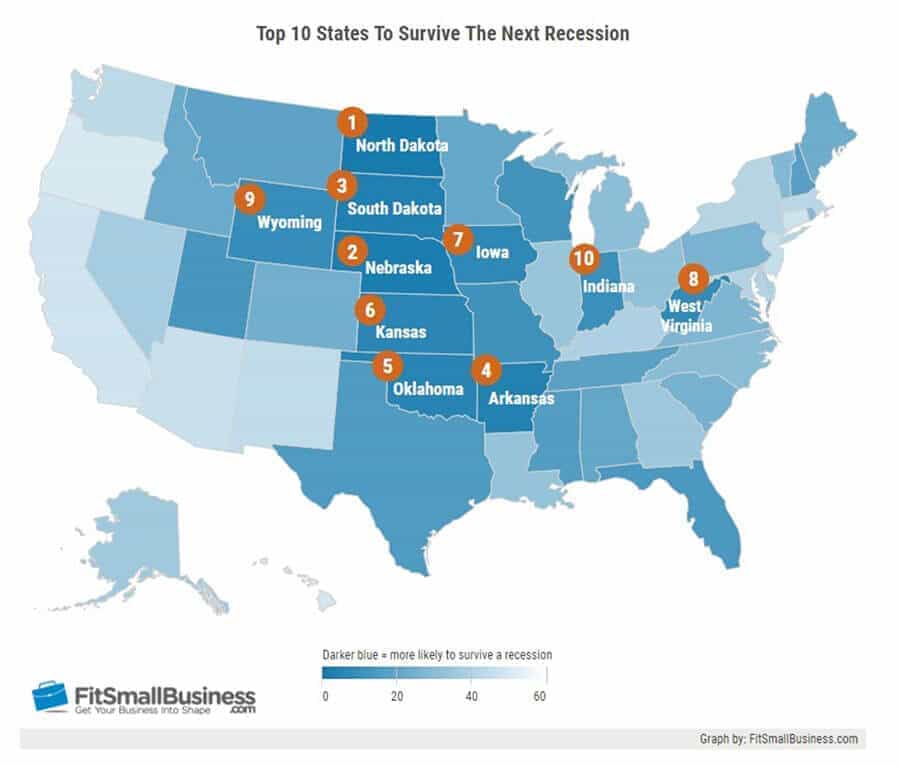

Who Exactly Will Survive The Next Recession?

By: Howard Dvorkin

College and NFL football seasons are well underway, and several notable upsets have already happened. What defines an “upset”?

Debt.com Scholarship Winner: Going To College While Teaching School

By: Howard Dvorkin

Holly Montsari graduated from college years ago, but now she’s going back to school while working in a school. Confused? Welcome to Montsari’s life.

Why 3 Obscure Polls Are Good News About America’s Debt

By: Howard Dvorkin

This marketing company spent four weeks interviewing 8,550 Americans. Conclusion: despite America’s debt, Americans love coupons,deals, and spending.

Will The Equifax Breach Be the Beginning Of Something Wonderful?

By: Howard Dvorkin

American businesses and citizens haven’t taken identity theft seriously, until now since the breach at Equifax, which might be a wonderful thing.

Car Insurance for Your Teen Will Drive You Crazy

By: Howard Dvorkin

Wonder how much it costs once your teenager starts driving? While we all complain about personal debt, we often forget that it’s not just personal.

What the Equifax Data Breach Means to Your Identity

By: Howard Dvorkin

When The Equifax data breach occured, 143 million Americans had their personal information exposed to identity theft. It’s complicated – and ironic.

Are Student Loans Going To Cause The Next Recession?

By: Howard Dvorkin

With more than $1.3 trillion in student loan debt, student loans are too big to fail. However, they might now be too big to succeed.

This Teenager Probably Knows More About Money Than You Do

By: Howard Dvorkin

Will Amouzou is 17, but he doesn’t aspire to be a sports star or movie star. He wants to be a chief financial officer. He’s our latest scholarship winner.