Featured Content

Browse by Topic

Recent News

What are credit repair companies and how do they work?

By: Emma Woodward | Source: Yahoo! Finance

“Think of a credit repair company like you’d think of a tax preparer. Sure, you can do your own income taxes, but sometimes it’s worth the money to hire a professional,” says Howard Dvorkin, CPA and chairman of Debt.com.

5 hacks to get the best deals on Amazon Prime Day — and other summer sales

By: Zoe Han | Source: MorningStar

But before signing up for an Amazon credit card, think carefully about how often you’ll actually use it, and whether you’ll be able to pay off the entire balance every month, said Howard Dvorkin, a financial advisor and chairman of Debt.com. “On paper, getting an Amazon credit card for Prime Day makes dollars and sense. In practice, it’s dangerous unless you’re super-disciplined,” he told MarketWatch in an email. “You need to be honest with yourself before making this decision,” he added.

8 Ways to Manage Money Stress

By: Geoff Williams | Source: U.S. News & World Report

But if you feel like it’s professional financial help you need for your money stress rather than a therapist, there are free places to go for that as well, says Howard Dvorkin, a certified public accountant and chairman of the debt education website, Debt.com. “There’s no shortage of free assistance,” Dvorkin says. “Your bank or credit union probably offer free online budgeting tools that can help you squeeze every last dime from your income. Nonprofit credit counseling agencies … offer you a free, in-depth debt analysis over the phone.”

Medical Credit Cards and Loans Carry a Heavy Burden

By: Donna Fuscaldo | Source: AARP

When it comes to medical bills, you aren’t alone. Debt.com’s Medical Debt Survey found that close to 6 in 10 consumers are having a hard time paying medical bills in the face of inflation. The good news is that there are ways to pay. for it without racking up expensive debt. For starters, if you’re offered a medical credit card with an interest-free period, make sure you can pay off the bills within that time frame. If that’s not realistic, request a payment plan directly with the provider instead. Some doctors will offer interest-free plans for multiple years. Make sure to get the payment plan in writing to avoid any of the doctor bills being sent to collections, says Howard Dvorkin, CPA, and chairman of Debt.com. If you have insurance and your provider declines to cover a procedure, Dvorkin says to appeal the decision. It also behooves you to go over the bill to spot any errors that may have added to the cost. Even saving a couple of thousand dollars can go a long way. “Health insurers make mistakes, too, so consumers should ask their insurance company about what they do and don’t cover. People with gap insurance should also check with their providers to see if their bills will be covered,” says Dvorkin. If all else fails and you have multiple medical debts, you can try to consolidate them into one loan. This will give you one monthly payment and potentially a lower interest rate. You can also try to settle the debt, although this will negatively impact your credit score. To settle, Dvorkin says to negotiate directly with the collection agency. “Consumers who find themselves with medical bills they can’t pay should prioritize keeping their bills out of collections — all while fighting to receive a reasonable price or payment plan,” says Dvorkin.

7 Things That Are Finally Getting Cheaper

By: Donna Fuscaldo | Source: AARP

Bank of America found in a recent report that U.S. credit and debit card spending was at its weakest pace in two years. “This is most likely a response to prices being higher overall and Americans tightening their belts to lessen the blow of inflation,” says Howard Dvorkin, CPA, who is the chairman of Debt.com.

How To Protect Your Savings: 9 Top Questions Answered by Experts

By: Nicole Spector | Source: GOBankingRates

“As long as the financial institution is insured, consumers are safe; and, if they are not insured, then they face possible risk,” said Howard Dvorkin, CPA and chairman of Debt.com. “People need to verify that their bank is FDIC insured and that they understand what happens with different types of accounts like joint accounts and retirement accounts.

It’s time to set your ‘financial boundaries’: Here’s how to say no to expensive invites and loan requests from friends

By: Eleanor Pringle | Source: Fortune

He was echoed by author Howard Dvorkin, chairman of Debt.com, who advises people to help their friends with work such as setting up the venue for a social gathering, instead of leaving money: “There are ways to meet your social obligations without ruining your bottom line.” “Financial boundaries resemble personal boundaries,” he added. “If you don’t set them early, everyone will cross them often. The problem is, crossing personal boundaries is uncomfortable. Crossing financial boundaries is costly.”

6 Ways to Eat Out on the Cheap

By: Donna Fuscaldo | Source: AARP

“Between labor and ingredient shortages, coupled with the unpredictability of transportation, it has led to rising consumer costs,” says Howard Dvorkin, chairman of Debt.com. “Food manufacturers are experiencing delays waiting for ingredients and in the end they are paying higher prices, so they are charging higher prices. It’s hard to tell if food costs will go down,” he notes. “More times than not, when costs rise they stay that way.”

Signs You Are Saving More Than You Need for Retirement

By: Yaёl Bizouati-Kennedy | Source: GOBankingRates

“I like to tell people that they should save enough money so that once they retire they don’t have to cut back their lifestyle,” said Howard Dvorkin, CPA and chairman of Debt.com. “Today, many people retire with debt that eats up their retirement income.”

Concerns about by now, pay later plans mount — along with consumer debt

By: Gary Guthrie | Source: ConsumerAffairs

ConsumerAffairs asked Howard Dvorkin, CPA and chairman of Debt.com, for the ugly truth anyone considering BNPL needs to know. “All BNPL providers are not the same. They offer very different terms, and you need to closely review the agreement,” Dvorkin said, noting that like credit cards, BNPL arrangements have varying terms on payback, interest rates, and fees. “This definitely isn’t like paper towels, where both Bounty and Brawny will wipe up a spill.”

Most Americans Don’t Know the Standard Tax Deduction Amount: Here Are the Top Details To Know

By: Yaёl Bizouati-Kennedy | Source: Yahoo! Finance

“People hear the phrase ‘death and taxes’ and think neither can change. While death doesn’t change, taxes certainly do. Or rather, the rules governing them change all the time,” said Howard Dvorkin, CPA and chairman of Debt.com. “The most important fact to know is that deductions come in two flavors: standard and itemized. Each reduces your taxable income. Sadly, you can’t use both at the same time. You must choose.”

Amid persistent inflation, 54% of Americans are using savings to pay for everyday expenses

By: Jessica Dickler | Source: CNBC

“There’s a great deal of economic risk right now, and if you’re borrowing from your future or someone else to cover expenses, an economic slowdown could be worse for you than it has to be,” said Howard Dvorkin, CPA and chairman of Debt.com.

Browse by Topic

Recent Columns

How To Win Money The Right Way

By: Howard Dvorkin

Debt.com’s first #MySecondChance giveaway winner was selected randomly, but she’s acting deliberately. Find out how you can do the same and win next time.

Paying Double: How Do Twins Afford College?

By: Howard Dvorkin

Debt.com revealed it’s 10th winner for their college scholarship, the first twin scholarship constructs a promising future for two kids.

Millennials Give Scary Answers to Silly Questions About Debt

By: Howard Dvorkin

The generation that will soon take over the world has yet to conquer its own financial woes. Millennial debt statistics aren’t promising.

Credit Card Debt: When “Typical” Is Horrible

By: Howard Dvorkin

Recent shows that the average credit card debt should strike fear into our families. Here’s how you can get out of that statistics.

Dvorkin On Debt: What Matters More, Money Or Power?

By: Howard Dvorkin

The answer depends on one factor. Sadly no one is talking about it. Howard Dvorkin CPA and Chairman at Debt.com, says why money or power isn’t the focus.

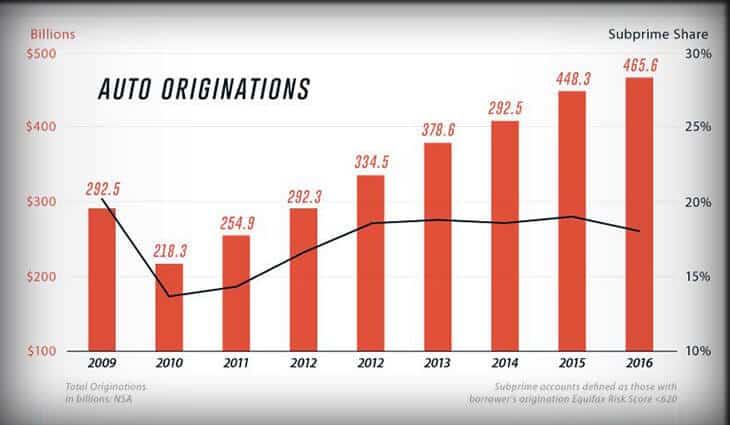

Are “Concerns” About an Auto Bubble Real?

By: Howard Dvorkin

The threat of an auto bubble might be lingering on the horizon, hopefully the credit bureaus are right and it isn’t as be as we think.

The Most Important New Year’s Resolution To Keep

By: Howard Dvorkin

You need to create a 2017 budget, although believe it or not thats’s a controversial statement. What side of the coin are you on?

President Trump’s 2018 Recession

By: Howard Dvorkin

The 2018 recession is coming, but it’s not really Trump’s fault. Unfortunately, due to the recent recession in 2007 we’re scheduled for another.

Dvorkin On Debt: An Insecure 2017 Prediction

By: Howard Dvorkin

Howard Dvorkin CPA and Chairman at Debt.com predicts that “Identity Theft 2017” will be an inevitable headline this year if things don’t change.

Dvorkin On Debt: Pan’s Plan

By: Howard Dvorkin

Ronald is the latest Debt.com scholarship winner, and it’s due to these three reasons. A commitment every morning, and the willingness to save.

Dvorkin On Debt: “Elder Financial Abuse” Is Real – And Growing

By: Howard Dvorkin

Elder financial abuse is worse than we previously thought. Make sure your elders are aware of the potential risks that could happen to them.

Dvorkin On Debt: Correcting Your New Year

By: Howard Dvorkin

With the holidays closing in, it’s common to panic while getting in last minute gifts. Consider fixing your credit as a gift to yourself. Here’s how.