Featured Content

Browse by Topic

Recent News

Valentine’s Day Tips for Talking About Money as a Couple

By: Adriana Morga | Source: The Washington Post

In more than 20 years as a financial adviser, Howard Dvorkin, chairman of Debt.com, has had plenty of couples approach him with money issues that eventually lead them to break up. “You should talk about money, lifestyle, goals and dreams,” he said. “Because (money) affects your dreams, and if you go into a relationship with debt, your dreams may be altered.”

What Happens If Your Taxes Do Not Go as Expected?

By: Yaël Bizouati-Kennedy | Source: GOBankingRates

“Doing taxes is like renovating a house. If it goes according to plan, everyone is shocked — including the professionals hired to do the job,” said Howard Dvorkin, CPA and chairman of Debt.com. “In both cases, people can seldom predict what they’re going to find once they dig in. If someone has had any change in income — for better or worse — the only surprise would be having no surprises.”

Survey: Lying About Money To Your Partner Is As Bad As Cheating

By: John Egan | Source: Forbes

Howard Dvorkin, chairman of Debt.com, says fear is a factor for the nearly 1 in 4 Americans who admit lying to a partner about finances and the more than 1 in 5 Americans who believe lying about finances is akin to other sorts of lying or infidelity.

I Have to Pay My Debt, So Why Doesn’t the US Government? The Truth Is Even More Complicated Than You Think

By: Yaёl Bizouati-Kennedy | Source: Yahoo! Finance

“In the simplest terms, the federal debt ceiling is a lot like your credit card bill. The debt ceiling is your balance — both you and the federal government have already charged a bunch of expenses. Now it’s time to pay. You write a check, but the federal government needs the House of Representatives to take formal action,” said Howard Dvorkin, Howard Dvorkin, CPA and Chairman of Debt.com.

Americans received the gift of unexpected debt this past holiday season — here’s what they can do to pay it down quicker

By: Ana Staples | Source: CNBC

“Prices are up for everything,” says Howard Dvorkin, CPA and chairman of Debt.com. ”[People] are trying to make ends meet but they didn’t want to come off looking like the Grinch during Christmas… They went to the store saying, ‘Okay, I’m only going to spend $25 for a shirt for uncle George.’ And you get to the checkout, and that $25 shirt is now $40.”

Consumers are piling on credit card debt, flashing signs of potential crisis

By: Breck Dumas | Source: Fox Business

Debt.com chairman Howard Dvorkin recommends anyone with credit card debt should launch a plan to pay it off now, prioritizing the cards with the highest interest rate first. He also urges people to track where their money is going and look for expenses that can be cut.

How to manage your personal loan and save money

By: Emma Woodward

“Rewrite your budget to include the monthly loan payments. If your debt-to-income ratio is too high with the loan, reconsider taking out a personal loan,” recommends Howard Dvorkin, CPA and Chairman of Debt.com.

25 Ways To Save Yourself From Your Debt Disaster

By: Jaime Catmull | Source: GOBankingRates

“Ask a trusted friend or financial advisor to look over your budget and ask them to be brutally honest,” said Howard Dvorkin, chairman at Debt.com. “Take their suggestions and revisit them in a month to check on your progress.”

How to Make More Than the Minimum Payment on a Credit Card

By: Katie Teague | Source: CNET

If you owe a significant amount of money on your credit card, your minimum payment will likely be around 2% to 3% of your balance, Debt.com resident expert and certified public accountant Howard Dvorkin told CNET. However, it could also be as low as 1%.

Store Credit Card Pitfalls to Avoid

By: Donna Fuscado | Source: AARP

If you carry a balance, suddenly, 20 percent off that TV doesn’t seem so appealing. “You should be looking at the interest rate, but most shoppers don’t look at that; they look at deals,” says Howard Dvorkin, a CPA and chairman of Debt.com. “You’ve got to be very, very careful.”

5 Black Friday Spending Traps to Avoid

By: Donna Fuscaldo | Source: AARP

“These guys (retailers) have had not one year, not two years but 100 years to figure out how to separate you from your money,” says Howard Dvorkin, chairman of Debt.com. “They are very good at it. They want it to be perceived that you are getting a deal, and sometimes that deal is not a real one.”

Tips And Tricks For Budgeting Your Holiday Shopping

By: Robyn Song | Source: Glam

“Really put some thought into this because you’re making a promise to yourself that this is it — you’re not buying anything more for anyone else,” Howard Dvorkin, chairman of Debt.com, tells Nasdaq.

Browse by Topic

Recent Columns

Dvorkin On Debt: Not A Holiday For Me

By: Howard Dvorkin

Holiday debt is piling up in November and December, making us dread January. When will Americans learn they can’t spend what they don’t have.

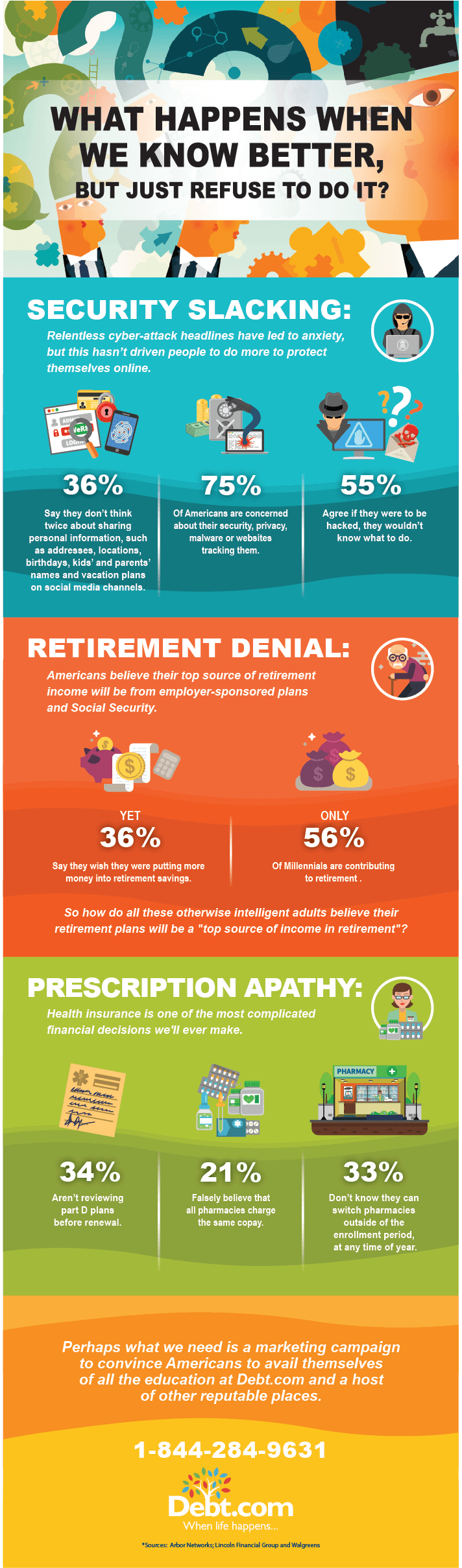

Dvorkin On Debt: What Happens When We Know Better?

By: Howard Dvorkin

Americans have the debt education needed to stop worrying about money. Yet, many still making simple mistakes when it comes to everyday choices.

Dvorkin On Debt: ‘Tis The Season For Holiday Stealing

By: Howard Dvorkin

While this is the time to give, many are trying to take away. Holiday safety tips are important, because that’s when your finances are at risk.

Dvorkin On Debt: What You Can Learn From Ryan Lochte’s First Credit Card

By: Howard Dvorkin

Ryan Lochte’s first credit card didn’t arrive until he was 32! No matter how old you are, it’s important to follow these tips with your new card.

The Hardest-Working Woman In Scholarships

By: Howard Dvorkin

Abby Marion has applied for 276 scholarships so far. By filling out all these scholarship applications, she’s managed to pay for three years of college!

Dvorkin On Debt: Who I’m Endorsing

By: Howard Dvorkin

How will Clinton and Trump help reduce debt? Find out what our expert’s election endorsements are. (Hint, it involves government credit counseling.)

Dvorkin On Debt: My Millennial Financial Obsession

By: Howard Dvorkin

We all worry about the millennial generation and its future financial success. With so much research on their opinions, where do they really stand?

Dvorkin On Debt: When TV News Is On the Money

By: Howard Dvorkin

Financial news is hard to deliver in an entertaining way. We would like to acknowledge reporters like Tina Martin, who encourage financial responsibility.

Dvorkin On Debt: Credit Cards Overtake Cash For The First Time Ever

By: Howard Dvorkin

A universal credit card might sound better than it actually is. See what our expert has to say about these credit cards and his advice to readers.

Dvorkin On Debt: Don’t Give It Up!

By: Howard Dvorkin

Follow these steps to avoid those pesky credit card thieves. Secure your credit card because you don’t know who could be watching.

Dvorkin On Debt: Blowing Up The Auto Bubble

By: Howard Dvorkin

Headlines about upcoming financial disasters, like the recent scare concerning the auto bubble, might have you on your toes. But are they accurate?

Dvorkin On Debt: A Clever Way To Teach Kids About Money

By: Howard Dvorkin

Teaching kids to save money should be implemented into our high school programs. However, we should also discuss this issue with parents.