Featured Content

Browse by Topic

Recent News

Can You Pay Off a Personal Loan Early?

By: Laura Gariepy | Source: Credible

“First, [the lender] can charge you a percentage of your loan balance. That’s usually around 2%,” he said. “Second, they can charge you a flat fee. Or third — and worst of all — they can actually charge you all the interest you’re saving by paying early.” “You don’t have to think so big. You can also pay off your loan early by nibbling away at it every month.”

Have Credit Card Debt? Here’s Why You Should Pay More Than the Minimum Payment

By: Katie Teague | Source: CNET

“Credit card companies make more money when the minimum payment is lower, so more money goes towards the interest rate and less towards the principal,” “Every credit card company is mandated by law to give you the credit card agreement,” “When you pay late, credit card companies can hit you with higher interest rates that won’t drop,”

Alternative Ways To Pay If You Don’t Have a Credit Card

By: Jordan Rosenfeld | Source: Yahoo Finance

“The downside to prepaid cards is that they have fees for activating and transferring money on to them,” he said. “Generally speaking, they are good to have available as a backup option if you are intending to use cash for your purchases.” “But a secured credit card actually builds your credit,” he said. “Of course, you have to make timely payments, but it’s like a set of training wheels for your financial bicycle.”

On the brink of a financial abyss called bankruptcy: the disparities that keep Latinos from their goals

By: Yngrid Fuentes | Source: Noticias Telemundo

“Bankruptcy filings are increasing because three costly factors have converged. First, inflation may not be rising as fast as before, but it’s not going down either. The longer inflation persists, the weaker Americans’ finances become,” “Second, student loan payments that were frozen for three and a half years were unfrozen in October, meaning 45 million people suddenly owe hundreds of dollars a month. Third, with credit card interest rates at record levels (an average of 25%) it is no longer possible to use plastic to fill income gaps.” “Most of your credit score is determined by a simple measurement called ‘payment history.’ All that means is: ‘Do you pay your bills on time?’ ”

How to Save for a House When You Have Kids

By: Rachel Morgan Cautero | Source: What To Expect

“You’ll need to look over your budget — if you already have debt, you will need to be prepared to take on the additional debt of a mortgage, explains Howard Dvorkin, CPA and chairman of Debt.com. You will also want to monitor your credit score, which will help you secure a mortgage loan, and educate yourself on the overall costs of homeownership. This will include insurance, property taxes, utilities and maintenance.”

Tips for Trimming Monthly Housing Expenses

By: Jean Chatzky | Source: SavvyMoney

“Extended warranties are intentionally confusing and limiting,” he explains. “If that washing machine breaks? It might be chalked up to ‘regular wear and tear,’ which is rarely covered.” If extended warranties were such great deals, he reasons, why do salespeople push them so hard? “Obviously, they’re cash cows for everyone but you.”

Americans are approaching their credit card limits ahead of holidays

By: Sam Bourgi | Source: Credit News

You can’t get out of debt if you don’t understand what’s keeping you there,” Debt.com’s chairman Howard Dvorkin told Fox Business.

Holiday Shopping 2023: 7 Reasons Not To Sign Up for a Store Credit Card This Year

By: Nicole Spector | Source: Yahoo Finance

“I hate store credit cards the way the Grinch hates children’s gifts,” said Howard Dvorkin, CPA, chairman of Debt.com. “They’re so costly, they should be classified as a weapon of financial destruction.”

5 Tips to Avoid the Holiday Credit Card Trap

By: Adam Shell | Source: AARP

“These cards come with expensive offers in order to get the card into people’s hands, and that’s not by accident,” said Howard Dvorkin, a CPA and chairman of Debt.com. “It’s very enticing when you’re standing at the register and the clerk says, ‘Can I interest you in a credit card you don’t have to make payments on for a year?’ ”

Average credit card balances top $6,000, a 10-year high, as delinquencies rise

By: Jessica Dickler | Source: CNBC

“Americans are addicted to credit cards, no question,” said Howard Dvorkin, a certified public accountant and the chairman of Debt.com.

Should you get a store credit card?

By: Donna Freedman | Source: Surviving and Thriving

Howard Dvorkin, chairman of Debt.com, points out that the annual percentage rate for retail credit cards is now 28.93% on average. Some retailers go higher; for example, Michael’s and Burlington charge an APR of 33.24% on their store cards. Used correctly, though, promotions use can “be part of a smart strategy to save money on large purchases like home appliances, furniture or a new computer,” according to Dvorkin.

Credit card balances spiked in the third quarter to a $1.08 trillion record. Here’s how we got here

By: Jessica Dickler | Source: CNBC

Now, “consumers are maintaining and supporting their lifestyles using credit card debt,” said Howard Dvorkin, a certified public accountant and the chairman of Debt.com.

Browse by Topic

Recent Columns

One More Reason Why I Still Fear An Auto-matic Recession

By: Howard Dvorkin

CPA and Debt.com founder Howard Dvorkin offers his next recession prediction that the crisis will start with an auto bubble, but it’s not about loans.

The Most Depressing Statistic of the Summer

By: Howard Dvorkin

Most families are worried about paying for their kids to go to college, but the most depressing fact of the summer has to do with family inheritance.

Small Business Isn’t A Partisan Issue

By: Howard Dvorkin

Howard Dvorkin CPA and Chairman of Debt.com explains why the problem with starting a small business isn’t a partisan issue.

Americans Are Buried in Debt, But What About the Rest of the World?

By: Howard Dvorkin

America is so buried in debt, we’re knocking countries such as France, Russia and China out of the water. Is it our student debt? Or our household debt?

3 Profitable Facts About Your Workplace

By: Howard Dvorkin

Most Americans are worried more about spending than spending. These facts about money management can not only make you more money, but help you save.

You’re More Likely To be A Victim Of This Crime If You Have Less To Steal

By: Howard Dvorkin

Why and how do people steal identities from those deeply in debt and without any money to take? Because they’re not expecting to face identity theft.

Make Money By Being Disloyal — To Your Credit Card

By: Howard Dvorkin

Your loyalty program isn’t saving you money, and it’s your fault. Unfortunately, consumers believe credit card perks are worth it.

This Scholarship Winner Is No Joke

By: Howard Dvorkin

John Pawloski is Debt.com’s 13th Scholarship winner. He recently decided to take his career in a different direction. Find out why!

Debt News You Probably Haven’t Heard — But Should

By: Howard Dvorkin

This Week: Debt.com discusses the debt news that should be in conversations, student loans, being passionate about your job, and passionately boycotting.

How One Of the 10 Commandments Can Predict Your Debt

By: Howard Dvorkin

The 10 Commandments shed some light on some ways your debt can get worse. Howard Dvorkin CPA and Chairman of Debt.com uses examples to explain why.

How The Government Adds To Student Loan Debt When It Tries To Lower It

By: Howard Dvorkin

What happens when an obsure lawsuit sways a federal judge? Choas. Financial reports have prices going up, what’s the cause?

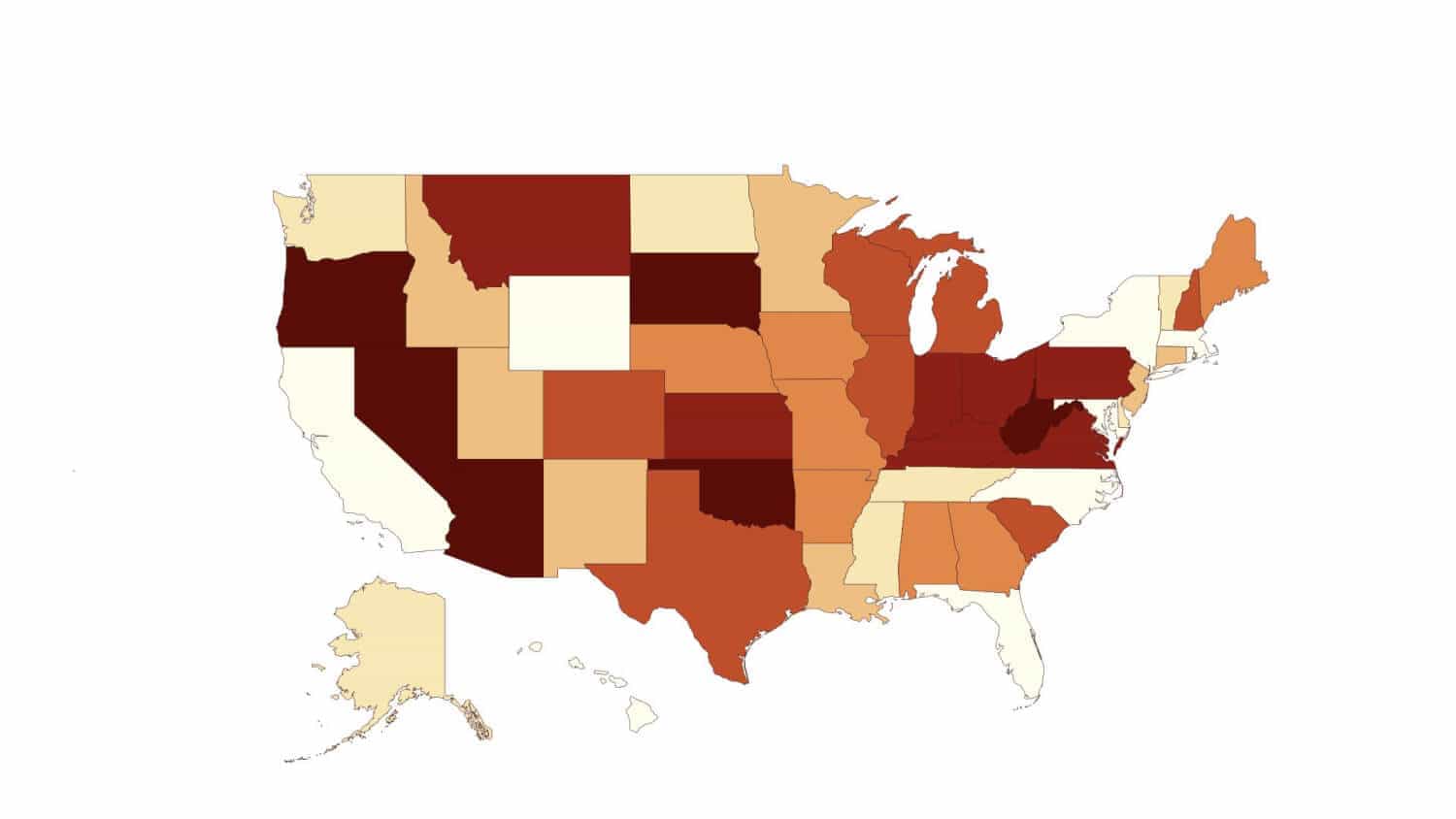

Here’s How To Lower Your Homeowners Insurance By Two-Thirds [map]

By: Howard Dvorkin

It’s not as simple as it sounds, but also not as hard as it looks: Raise your credit score, and you can lower your homeowners insurance rate.